Bond™ Advisory Services Group

Consolidation Services

Many business consolidation efforts built on a traditional “buy and build” roll-up strategy do not achieve their intended economic results. Additionally, traditional roll-up strategies transfer value creation into the hands of private equity or a large platform company, rather than vesting it with the participating companies.

We believe that the consolidation process should be accomplished with a smarter and more equitable approach. With The Partnership Roll Up™ (PRU™), Bond connects sophisticated capital with high quality companies in a way that minimizes risk and protects value among participants, mitigating typical roll-up stumbling blocks such as competing owner egos, disparate visions, a multiplicity of systems and processes, related party obligations, and inconsistent visions.

In a traditional strategy, a platform company purchases bolt-on entities using limited cash and seller notes, which are later refinanced on critical mass is obtained. The PRU™ starts with a single platform company and a consensus-minded owner in an industry that allows for geographic or service offering expansion. The strategy rests upon building a regional or national map with similar companies, or taking a strong core offering and adding new, ancillary services.

This process is further enhanced when the parties know each other, whether from industry conferences, boards, or peer groups. A forcing function is also helpful. For example, consolidation in the supply chain or the customer marketplace will force a thought process that might not have been an acceptable alternative in the past. Ultimately, the key driver will be the ability to create critical mass, competitive differentiation, succession plans, and stronger teams – resulting in a larger organization with liquidity options that were not available to the individual SMB owner. This new organization is owned by all partners, allowing individual partner companies to address local market needs and maintain independence while leveraging the their newfound critical mass to meet the needs of global brands. Over time, partner companies align operational aspects of the business, from back office to sales and support. Partner companies are simultaneously merged, achieving a massive increase in valuation after executing a detailed integration plan.

Growth Consulting

A sound strategic plan is the roadmap to achieving your vision and the evidence investors look for in making sound investment decisions. Developing that plan starts with solidifying the answers to some basic questions. We’ll begin with the following:

- What solution are you bringing to your market and what differentiates that solution from others’ offerings?

- Who are your clients and how do you differentiate from your competitors?

- How will you create operating efficiencies, improve margins and ultimately increase cash flow?

- How is your company capitalized and how will you fund the opportunities that take you to the next level?

Bond advises senior management teams on strategic plan development and the various financing options available to fund growing companies. You can count on the expertise of our experienced team to help you formulate a strategic plan that helps you achieve your vision.

Fractional CFO Program

As the owner of a privately held company, you are constantly faced with challenges: optimizing cash flow, maximizing profitability, accelerating growth, and planning your exit strategy. Our fractional CFO's partner with you as an advisor to help you achieve your goals and develop a game plan for those strategic, financial, and business objectives. Your Bond CFO then provides accountability to ensure that you reach those goals.

As your trusted advisor in the capacity of CFO, we carefully listen to your aspirations, challenges, and frustrations. We recognize that every business is unique and that while it may share commonalities with other businesses, it requires a customized approach to align with your unique desires, priorities, culture and budget. We then collaborate with your team to provide CFO services, business consulting and exit strategies prioritized to navigate your company from its current state to the desired end state – implemented and executed at a pace that you are comfortable with, both operationally and financially.

Talent Recruitment

When a company is in need of senior level management skills not currently available on the team, we can provide staffing support for a short-term bridge event such as a merger, acquisition, capital raise, restructuring or turnaround. When key executives are pulled away from their usual work during a transaction, whether it be a capital raise, an acquisition or a sale, the core business can lose focus. If the core business falters, so does any transaction. Bond maintains a strong roster of in-house operating experts to assist senior management in getting from where they are to where they want to be without losing momentum.

You can trust that Bond’s operating expertise will help to assure that your transaction is completed on time and on budget, supported by an operating team of seasoned experts.

Performance Marketing

Driving increased sales of your product or service and moving toward a recurring revenue model is the best way to organically grow your business, maximize the value of your company, and secure the capital needed to fund your growth.

- What is your company’s value proposition?

- What differentiates your company? What makes it unique? Do you have a “secret sauce”?

- Are your products patented or proprietary?

- How do you access new clients?

- How do you interact with you existing clients?

The answers to these questions determine the appropriate strategy for honing the effectiveness of your marketing and form the basis of your ability to market your securities when you raise capital. The Bond team helps our partner companies discover opportunities that had not previously considered, and brings these opportunities within reach by drawing from our vast network to help clients get to where they need to be from a marketing and distribution perspective.

We connect sophisticated capital with high quality companies in a way that minimizes risk and maximizes equity value for all the right reasons.

Building dynamic corporate culture

Sometimes taking it to the next level requires skills and experiences your team lacks. Bond can help you identify, negotiate and hire those key managers that you’ll need to grow your business.

- How strong and deep is your bench?

- Are you lacking critical skills necessary to achieve your growth objectives?

- Do your incentive programs align your team toward your vision?

- How efficient are your benefit programs? Are they taking care of your people?

We work with clients to help them identify, recruit and incentivize high-impact senior executives and board members. We possess the expertise to help you instill HR best practices across your organization.

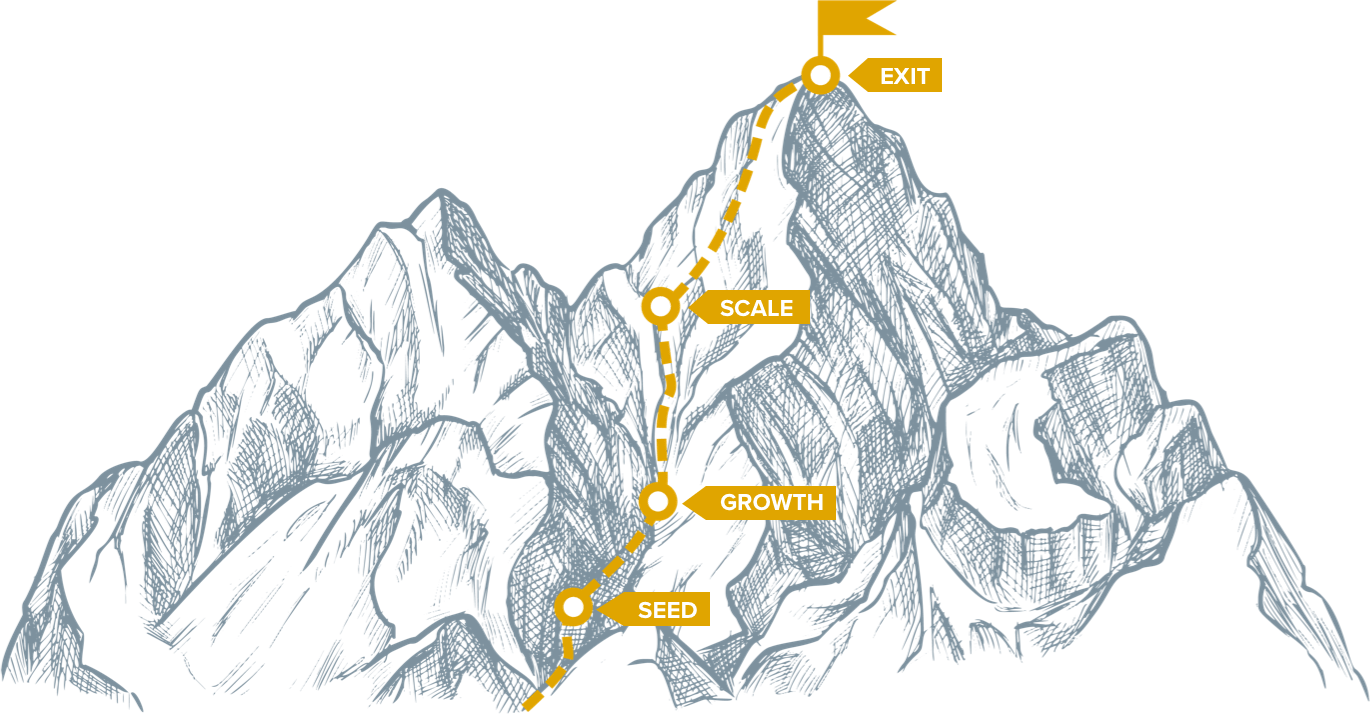

The journey

starts here

If you believe that your company is ready for the next big step, let’s connect and build a realistic path to get where you want to be.

Bond™ Advisory Services Group

Consolidation Services

Many business consolidation efforts built on a traditional “buy and build” roll-up strategy do not achieve their intended economic results. Additionally, traditional roll-up strategies transfer value creation into the hands of private equity or a large platform company, rather than vesting it with the participating companies.

We believe that the consolidation process should be accomplished with a smarter and more equitable approach. With The Partnership Roll Up™ (PRU™), Bond connects sophisticated capital with high quality companies in a way that minimizes risk and protects value among participants, mitigating typical roll-up stumbling blocks such as competing owner egos, disparate visions, a multiplicity of systems and processes, related party obligations, and inconsistent visions.

In a traditional strategy, a platform company purchases bolt-on entities using limited cash and seller notes, which are later refinanced on critical mass is obtained. The PRU™ starts with a single platform company and a consensus-minded owner in an industry that allows for geographic or service offering expansion. The strategy rests upon building a regional or national map with similar companies, or taking a strong core offering and adding new, ancillary services.

This process is further enhanced when the parties know each other, whether from industry conferences, boards, or peer groups. A forcing function is also helpful. For example, consolidation in the supply chain or the customer marketplace will force a thought process that might not have been an acceptable alternative in the past. Ultimately, the key driver will be the ability to create critical mass, competitive differentiation, succession plans, and stronger teams – resulting in a larger organization with liquidity options that were not available to the individual SMB owner. This new organization is owned by all partners, allowing individual partner companies to address local market needs and maintain independence while leveraging the their newfound critical mass to meet the needs of global brands. Over time, partner companies align operational aspects of the business, from back office to sales and support. Partner companies are simultaneously merged, achieving a massive increase in valuation after executing a detailed integration plan.

Growth Consulting

A sound strategic plan is the roadmap to achieving your vision and the evidence investors look for in making sound investment decisions. Developing that plan starts with solidifying the answers to some basic questions. We’ll begin with the following:

- What solution are you bringing to your market and what differentiates that solution from others’ offerings?

- Who are your clients and how do you differentiate from your competitors?

- How will you create operating efficiencies, improve margins and ultimately increase cash flow?

- How is your company capitalized and how will you fund the opportunities that take you to the next level?

Bond advises senior management teams on strategic plan development and the various financing options available to fund growing companies. You can count on the expertise of our experienced team to help you formulate a strategic plan that helps you achieve your vision.

Fractional CFO Program

As the owner of a privately held company, you are constantly faced with challenges: optimizing cash flow, maximizing profitability, accelerating growth, and planning your exit strategy. Our fractional CFO's partner with you as an advisor to help you achieve your goals and develop a game plan for those strategic, financial, and business objectives. Your Bond CFO then provides accountability to ensure that you reach those goals.

As your trusted advisor in the capacity of CFO, we carefully listen to your aspirations, challenges, and frustrations. We recognize that every business is unique and that while it may share commonalities with other businesses, it requires a customized approach to align with your unique desires, priorities, culture and budget. We then collaborate with your team to provide CFO services, business consulting and exit strategies prioritized to navigate your company from its current state to the desired end state – implemented and executed at a pace that you are comfortable with, both operationally and financially.

Talent Recruitment

When a company is in need of senior level management skills not currently available on the team, we can provide staffing support for a short-term bridge event such as a merger, acquisition, capital raise, restructuring or turnaround. When key executives are pulled away from their usual work during a transaction, whether it be a capital raise, an acquisition or a sale, the core business can lose focus. If the core business falters, so does any transaction. Bond maintains a strong roster of in-house operating experts to assist senior management in getting from where they are to where they want to be without losing momentum.

You can trust that Bond’s operating expertise will help to assure that your transaction is completed on time and on budget, supported by an operating team of seasoned experts.

Performance Marketing

Driving increased sales of your product or service and moving toward a recurring revenue model is the best way to organically grow your business, maximize the value of your company, and secure the capital needed to fund your growth. This requires a high-impact marketing plan that answers many questions.

- What is your company’s value proposition?

- What differentiates your company? What makes it unique? Do you have a “secret sauce”?

- Are your products patented or proprietary?

- How do you access new clients?

- How do you interact with you existing clients?

The answers to these questions determine the appropriate strategy for honing the effectiveness of your marketing and form the basis of your ability to market your securities when you raise capital. The Bond team helps our partner companies discover opportunities that had not previously considered, and brings these opportunities within reach by drawing from our vast network to help clients get to where they need to be from a marketing and distribution perspective.

We connect sophisticated capital with high quality companies in a way that minimizes risk and maximizes equity value for all the right reasons.

Building dynamic corporate culture

Sometimes taking it to the next level requires skills and experiences your team lacks. Bond can help you identify, negotiate and hire those key managers that you’ll need to grow your business.

- How strong and deep is your bench?

- Are you lacking critical skills necessary to achieve your growth objectives?

- Do your incentive programs align your team toward your vision?

- How efficient are your benefit programs? Are they taking care of your people?

We work with clients to help them identify, recruit and incentivize high-impact senior executives and board members. We possess the expertise to help you instill HR best practices across your organization.

The journey

starts here

If you believe that your company is ready for the next big step, let’s connect and build a realistic path to get where you want to be.